Update (11/15/2017): The Tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation was recently made aware of a calculation error affecting estimates in this paper. The figures in this report have been corrected and are now accurate. This analysis applies to the House version of the Tax Cuts and Jobs Act, as originally introduced; it does not take into account amendments added to the bill after its initial introduction, except for certain changes to inflation indexing Inflation indexing refers to automatic cost-of-living adjustments built into tax provisions to keep pace with inflation. Absent these adjustments, income taxes are subject to “bracket creep” and stealth increases on taxpayers, while excise taxes are vulnerable to erosion as taxes expressed in marginal dollars, rather than rates, slowly lose value. . The original Tax Foundation estimate of the bill can be found here.

On November 2, 2017, Chairman Kevin Brady (R-TX) of the House Committee on Ways and Means released a tax reform plan, known as the House Tax Cuts and Jobs Act. The plan would reform the individual income tax code by lowering tax rates on wages, investment, and business income; broadening the tax base; and simplifying the tax code. The plan would lower the corporate income tax rate to 20 percent and move the United States from a worldwide to a territorial system of taxation.

Our analysis finds that the plan would reduce marginal tax rates on labor and investment. As a result, we estimate that the plan would increase long-run GDP by 3.5 percent. The larger economy would translate into 2.7 percent higher wages and result in 890,000 more full-time equivalent jobs.

We find that the larger economy would also generate more than $900 billion more in federal tax revenues, which would substantially reduce the estimated revenue loss from the tax reform plan. The Joint Committee on Taxation estimates the static revenue loss from the plan to total $1.5 trillion over a decade. Because of technical differences between our models, the TAG model generates a slightly higher estimate of the revenue loss from the plan–$1.98 trillion using a current law baseline.

Irrespective of these differences, the $900 billion in new tax revenues generated by the economic growth would go a long way toward bringing the plan closer to revenue neutral within the first ten years.

| Note: Tax brackets are for single tax filers. Brackets differ for married and head of household filers. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Current Law | House Tax Cuts and Jobs Act | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10% | > | $0 | 12% | > | $0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 15% | > | $9,525 | 25% | > | $45,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 25% | > | $38,700 | 35% | > | $200,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 28% | > | $93,700 | 39.6% | > | $500,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 33% | > | $191,450 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35% | > | $424,950 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 39.6% | > | $426,700 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Stay Informed on the Latest in Tax Policy

According to the Tax Foundation’s Taxes and Growth Model, the House Tax Cuts and Jobs Act would increase the long-run size of the U.S. economy by 3.5 percent (Table 2). The larger economy would result in 2.7 percent higher wages and a 9.3 percent larger capital stock. The plan would also result in 890,000 more full-time equivalent jobs.

The larger economy and higher wages are due chiefly to the significantly lower cost of capital under the proposal, which is mainly due to the lower corporate income tax rate.

| Source: Tax Foundation Taxes and Growth Model, November 2017. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in long-run GDP | 3.5% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in long-run capital stock | 9.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in long-run wage rate | 2.7% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Change in long-run full-time equivalent jobs | 890,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

If fully enacted, the proposal would reduce federal revenue by $1.98 trillion over the next decade on a static basis (Table 3) using a current law baseline. The plan would reduce individual income tax revenue, including revenue from noncorporate business filers, by $330 billion over the next decade. Corporate tax revenues would fall by $1.49 trillion. The remainder of the revenue loss would be due to the eventual repeal of the estate.

On a dynamic basis, the plan would reduce federal revenue by $1.08 trillion over the next decade. The larger economy would boost wages and thus broaden both the income and payroll tax base. As a result, the federal government would see a smaller individual income tax revenue loss of $782 billion, but would see $268 billion in additional payroll tax A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. revenue. Corporate income tax revenue would decline by a smaller amount on a dynamic basis, totaling $987 billion. The corporate tax revenue loss would be greater in the short term, because of the temporary expensing provision, which would encourage more investment and result in businesses taking larger deductions for capital investments.

The House Tax Cuts and Jobs Act contains a number of significant base broadeners. The plan would eliminate all itemized deductions except for three: the mortgage interest deduction, the charitable contribution deduction, and the deduction for state and local property taxes. The deduction for property taxes would be capped at $10,000, while the mortgage interest deduction would be capped at $500,000 of principal on a newly-purchased home. This change would increase federal revenue by $1.52 trillion over the next decade.

The plan would also expand the standard deduction and eliminate the personal exemption, but would add a personal exemption of $300 for filers and $300 for non-child dependents, and expand the child tax credit from $1,000 to $1,600. These changes, considered together, would decrease federal revenues by $266 billion over the next decade.

On the business side, the bill includes several base broadeners. First, the deduction for net interest paid would be limited to 30 percent of a company’s earnings before interest, taxes, depreciation, and amortization (EBITDA). The plan would also repeal multiple business deductions and credits, such as the deduction for entertainment expenses, the deduction for domestic production activities (section 199), the new markets tax credit, and the orphan drug credit. Deductions for net operating losses would be restricted to 90 percent of net taxable income, but could be carried forward indefinitely and increased by a factor reflecting inflation and the real return to capital. The elimination of business credits and deductions, the limit on net operating losses, and the other business changes would bring in an additional $635 billion over the next decade. The results below also account for the impact of inbound corporate profit shifting, which would result from a lower statutory rate.

The largest source of revenue loss in the first decade would be the individual and corporate rate cuts and faster depreciation of capital investments. Consolidating individual income tax brackets to 12 percent, 25 percent, 35 percent, and 39.6 percent (with a “bubble rate,” which eliminates the benefit of the 12 percent rate for high-income earners) would reduce revenues by $1.52 trillion over the next decade, while cutting the corporate income tax rate to 20 percent would reduce revenues by $1.54 trillion over the next decade. Capping the tax rate on pass-through businesses would reduce revenues by $531 billion, after accounting for the new individual bracket schedule and the anti-abuse provisions. The anti-abuse rules would include several provisions, including limiting the lower rate to 30 percent of income and exempting specific industries.[1] The temporary full expensing provision and the expansion of section 179 would reduce revenue by $340 billion over the next decade.

Individual

Eliminate the individual alternative minimum tax.

Consolidate the current seven tax brackets into four and phase out the benefit of the 12 percent bracket for high-income households

Increase the standard deduction to $12,200 / $18,300 / $24,000

Repeal personal exemptions.

Increase the child tax credit amount to $1,600. Initially, only the first $1,000 is refundable. Increase the nonrefundable portion of the child tax credit by $300 for each non-child household member, available for five years. Increase the phaseout thresholds for the child tax credit to $230,000 for married filers and $115,000 for other filers

Repeal all itemized deductions except for the mortgage interest deduction (capped at $500,000 of acquisition debt on a principal residence), the charitable deduction, and the deduction for state and local property taxes paid (capped at $10,000), increase contribution limits for the charitable contributions deduction, repeal the Pease limitation on itemized deductions

Consolidate education tax benefits, repeal several personal tax credits, limit the applicability of certain refundable tax credits, repeal or limit several exclusions, and modify rules for tax-preferred retirement accounts

Index bracket thresholds and the standard deduction amount to chained CPI. Index the refundable portion of the child credit to chained CPI until it reaches $1,600 (economic effect not modeled)

Individual subtotal

Business

Lower the corporate tax rate to 20 percent.

Create a maximum tax rate of 25 percent on qualified pass-through business income, accompanied by several anti-abuse rules

Limit interest deductions to 30 percent of adjusted earnings for businesses with over $25 million in gross receipts

Allow businesses to deduct 100 percent of short-lived investments for 5 years. Increase the §179 expensing amount from $500,000 to $5 million, and increase the phaseout threshold from $2 million to $20 million

Eliminate business credits, deductions, and other tax preferences and enact miscellaneous changes to business taxation

Move to a territorial tax system, accompanied by several rules to prevent base erosion

Enact a deemed repatriation of deferred foreign-source income, at rates of 5% and 12%

Business subtotal

TOTAL

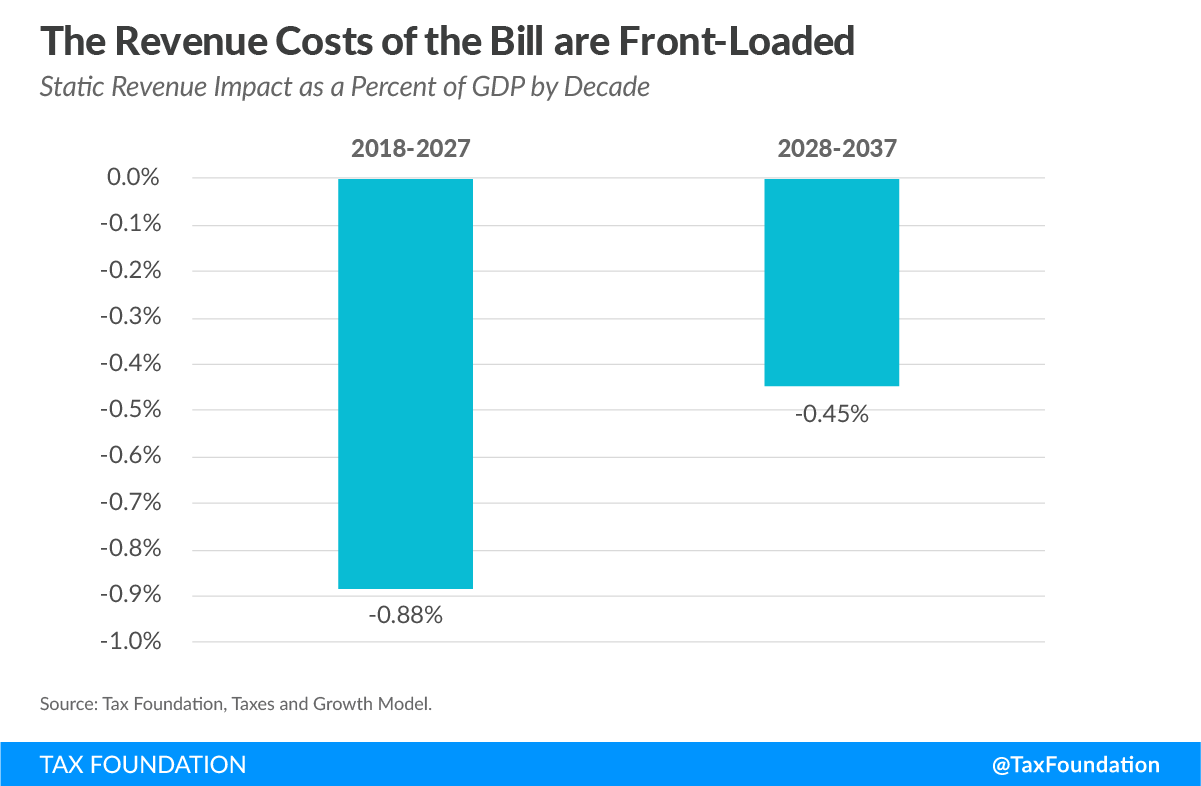

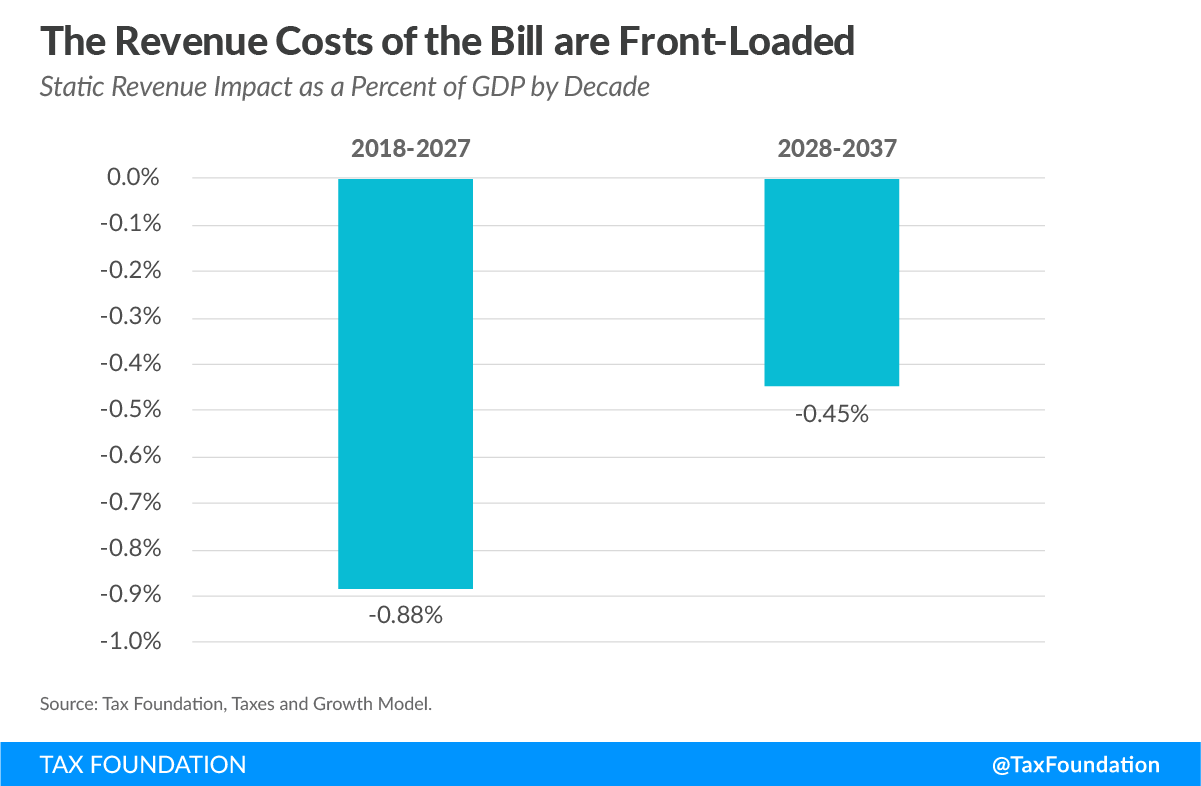

Although the plan would reduce federal revenues by $1.98 trillion over the next 10 years, the plan would also have a smaller impact on revenues in the second decade. There are several provisions that contribute to the first decade’s higher transitional costs, including: changes to expensing rules, net interest, and changes to inflation measures.

First, the plan would index tax brackets, the standard deduction, and other provisions to chained CPI, rather than CPI. This provision would raise relatively little revenue in the short term, but would raise more revenue over time as these two inflation indices diverge.

As mentioned previously in this report, moving to temporary full expensing Full expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. and a temporary expansion of the Section 179 deduction would reduce revenues in the first decade by $340 billion. Because these provisions are currently slated to expire after five years, their impacts in the second decade are limited. However, any future changes to these provisions, such as extending them or making them permanent, could impact revenues in the future.

The plan also limits the net interest deduction for businesses. As a result, businesses would continue to deduct interest from loans acquired before enactment of the plan, reducing the amount of revenue this provision would raise in the first decade. In the second and subsequent decades, as old debt is retired, less interest would be deductible, resulting in more federal revenues.

The plan includes a major transitional revenue raiser: deemed repatriation. This proposal would tax corporations on their current deferred offshore profits and raise $223 billion over the next decade. We assume that this provision would only raise revenue in the first decade.

Taken together, these results mean that the plan would cost less in future decades. We estimate that this bill would reduce federal revenues by 0.88 percent of GDP in the first decade compared to 0.45 percent of GDP in the second decade.

Second Decade Static Federal Revenue Estimate, 2028-2037 ($ billions)

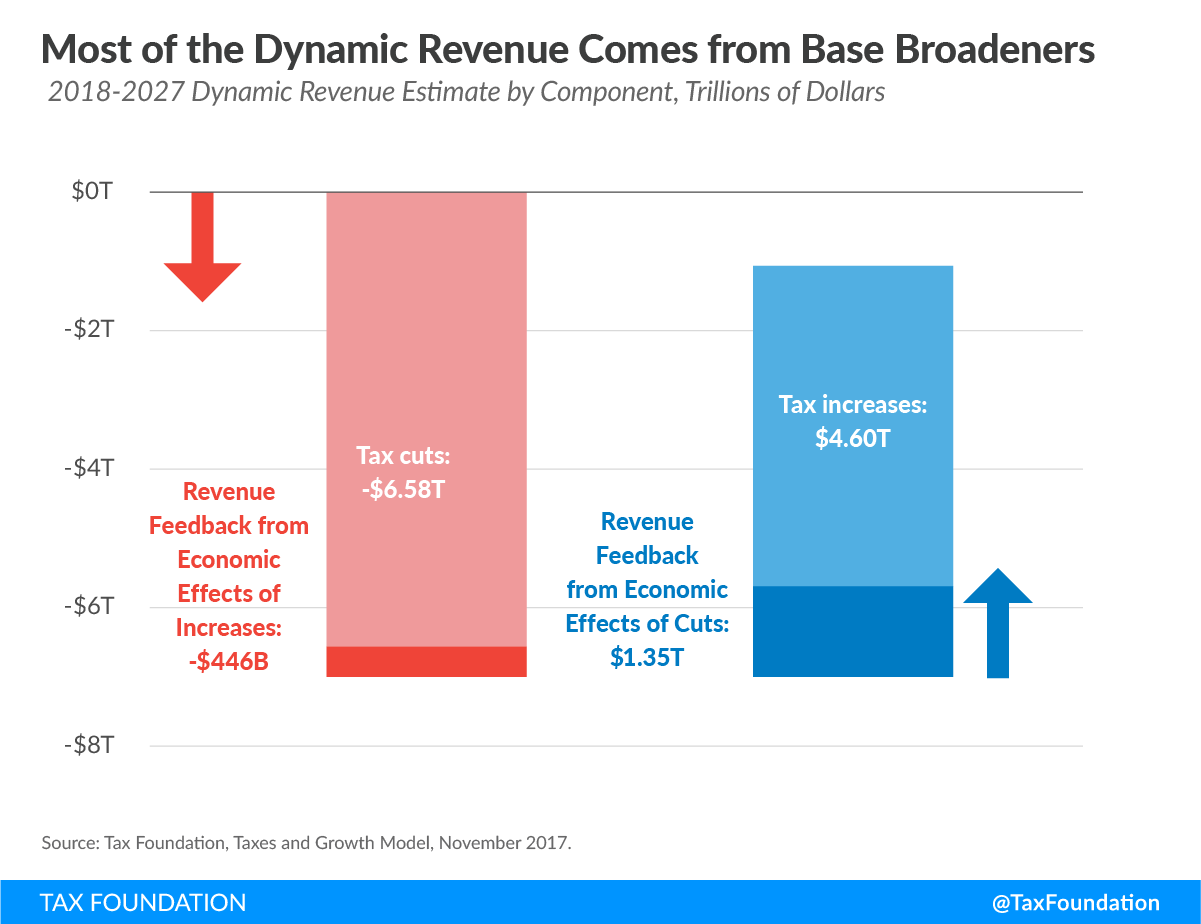

The dynamic revenue impact of -$1,076 billion over the next decade can be broken down into three components: tax reductions, economic growth, and revenue raisers.

The tax reductions in this plan include, but are not limited to, the cut in the corporate income tax rate to 20 percent, temporary full expensing of capital investments, and the reduction in marginal tax rates for most individuals. Combined, these tax cuts would reduce federal revenues by $6.58 trillion over the next decade, if enacted alone.

The second piece is the expected increase in revenue due to economic growth. The bill would reduce marginal tax rates on work and investment. Our model finds that these marginal tax rates would significantly increase the long-run size of the economy. The larger economy would boost wages, increasing the tax base The tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , especially for the individual income and payroll taxes. The resulting growth would reduce the 10-year cost of the plan by approximately $900 billion, on net.

Finally, the revenue raisers in the plan, such as the elimination of several itemized deductions for individuals and the repeal of many businesses tax expenditures, would significantly expand the tax base, reducing the revenue loss of the tax plan by $4.60 trillion over the next decade.

On a static basis, the House Tax Cuts and Jobs Act would increase the after-tax incomes of taxpayers in every taxpayer group in 2018. The bottom 80 percent of taxpayers (those in the bottom four quintiles) would see an average increase in after-tax income ranging from 0.8 percent to 2.4 percent. Taxpayers in the top 1 percent would see the largest increase in after-tax income on a static basis, of 7.5 percent, driven by the lower pass-through tax rate and the lower corporate income tax.

By 2027, the distribution of the federal tax burden would look different, for several reasons. First, the bill includes several temporary provisions, including the $300 personal credit and increased expensing for capital investments. Because these provisions would expire by 2027, taxpayers would not benefit from them in that year. Second, by 2027, taxpayers would be subject to the effect of indexing bracket thresholds to chained CPI, which would reduce the benefit of the increased standard deduction and individual income tax cuts. Finally, by 2027, the refundable portion of the child tax credit would increase significantly relative to current law.

Accounting for these factors, most groups of taxpayers would still see an increase in after-tax income, on average, in 2027. The bottom 80 percent of taxpayers would see an average increase in after-tax income ranging from 0.4 percent to 0.9 percent. Taxpayers between the 90 th and 99 th percentiles would see a slight average decrease in static after-tax income. The top 1 percent would see the largest increase in after-tax income on a static basis, of 3.3 percent.

Additionally, by 2027, the economic effects of a tax bill will largely have phased in. Taking these effects into account, all taxpayers would see an increase in after-tax incomes of at least 3.1 percent, with the lowest increase for those between 95 and 99 percent of income. The top 1 percent of all taxpayers would see an increase in after-tax income of 3.4 percent on a dynamic basis.

These dynamic results include the impact of both individual and corporate income tax changes on the United States economy. Static estimates assume that 25 percent of the cost of the corporate income tax is borne by labor. Dynamic estimates assume that 70 percent of the full burden of the corporate income tax is borne by labor, due to the negative effects of the tax on investment and wages.

| Source: Tax Foundation Taxes and Growth Model, March 2017. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| All changes, 2018 | All changes, 2027 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income Group | Static | Income Group | Static | Dynamic | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0% to 20% | 0.8% | 0% to 20% | 0.4% | 4.1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20% to 40% | 1.4% | 20% to 40% | 0.7% | 4.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40% to 60% | 2.2% | 40% to 60% | 0.5% | 4.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60% to 80% | 2.4% | 60% to 80% | 0.9% | 4.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 100% | 3.6% | 80% to 100% | 1.1% | 3.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 90% | 2.4% | 80% to 90% | 0.8% | 4.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% to 95% | 1.5% | 90% to 95% | -0.1% | 3.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 95% to 99% | 1.6% | 95% to 99% | -0.3% | 3.1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 99% to 100% | 7.5% | 99% to 100% | 3.3% | 3.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 2.9% | TOTAL | 0.9% | 3.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

On the afternoon of November 2, 2017, the Joint Committee on Taxation released a static estimate of the revenue effects of the House Tax Cuts and Jobs Act.[2] While preparing this report, the Tax Foundation relied in several instances on the Joint Committee’s estimates, particularly regarding tax provisions about which little public data exists. However, for most major provisions of the bill, the Tax Foundation estimated revenue effects using its own revenue model. On some provisions, the Tax Foundation model results were quite similar to those of the Joint Committee; for other provisions, the results diverged.

Overall, the Joint Committee on Taxation estimated that the House Tax Cuts and Jobs Act would reduce federal revenue by $1.43 trillion between 2018 and 2027. This is a lower cost estimate than the Tax Foundation’s static score of $1.98 trillion.

The bulk of the discrepancy between the static scores of the Joint Committee on Taxation and those of the Tax Foundation can be traced to three provisions: lowering individual rates, lowering the corporate rate, and enacting temporary expensing for short-lived assets. The Tax Foundation’s higher estimate for the cost of consolidating and lowering individual tax rates may be due to the fact that the Tax Foundation’s model utilizes taxpayer microdata from 2008, while the Joint Committee’s model may have access to more recent taxpayer data. The Tax Foundation’s higher estimate for the cost of lowering the corporate tax rate may be due to more aggressive assumptions by the Joint Committee regarding the extent of inbound profit shifting Profit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. that would result from a lower corporate rate. Finally, it is well-known that the Joint Committee’s model finds smaller static revenue effects from changes to depreciation and cost recovery Cost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker ’s productivity and wages. than outside models. This may be due to differing assumptions about businesses with net operating losses.[3]

There are three primary sources of uncertainty in modeling the provisions of House Tax Cuts and Jobs Act: the significance of deficit effects, the timing of economic effects, and expectations regarding the extension of temporary provisions.

Some economic models assume that there is a limited amount of saving available to the United States to fund new investment opportunities when taxes on investment are reduced, and that when the federal budget deficit increases, the amount of available saving for private investment is “crowded-out” by government borrowing, which reduces the long-run size of the U.S. economy. While past empirical work has found evidence of crowd-out, the estimated impact is usually small. Furthermore, global savings remain high, which may help explain why interest rates remain low despite rising budget deficits. We assume that a deficit increase will not meaningfully crowd out private investment in the United States.[4]

We are also forced to make certain assumptions about how quickly the economy would respond to lower tax burdens on investment. There is an inherent level of uncertainty here that could impact the timing of revenue generation within the budget window.

Finally, we assume that temporary tax changes will expire on schedule, and that business decisions will be made in anticipation of this expiration. To the extent that investments are made in the anticipation that temporary expensing provisions might be extended, economic effects could exceed our projections.

The House Tax Cuts and Jobs Act represents a dramatic overhaul of the U.S. tax code. Our model results indicate that the House Tax Cuts and Jobs Act would be pro-growth, boosting long-run GDP by 3.5 percent and increasing the domestic capital stock by 9.3 percent. Wages, long stagnant, would increase by 2.7 percent, while the reform would produce 890,000 new jobs. These economic effects would have a substantial impact on revenues as well, as indicated by the plan’s significantly lower revenue losses under dynamic scoring. On a static basis, the plan would reduce federal revenue by $1.98 trillion over the decade, with some of the revenue loss coming from one-time transitional costs.

The distributional tables included in the paper reflect all tax changes in the House Tax Cuts and Jobs Act. As noted above, much of the increase in after-tax incomes for higher-income earnings is attributable to changes in business taxation, such as the lower corporate income tax rate and the lower pass-through business income tax rate. For reference, we have included distributional tables of the personal income tax changes only, including changes to individual income tax rates, deductions, and credits.

| Personal changes only, 2018 | Personal changes only, 2027 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income Group | Static | Income Group | Static | Dynamic | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: Tax Foundation Taxes and Growth Model, March 2017. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0% to 20% | 0.1% | 0% to 20% | 0.2% | 0.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20% to 40% | 0.7% | 20% to 40% | 0.4% | 0.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40% to 60% | 1.4% | 40% to 60% | 0.3% | 0.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60% to 80% | 1.6% | 60% to 80% | 0.6% | 0.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 100% | -0.3% | 80% to 100% | -0.8% | -0.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 90% | 1.4% | 80% to 90% | 0.5% | 0.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% to 95% | 0.3% | 90% to 95% | -0.4% | -0.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 95% to 99% | -0.5% | 95% to 99% | -1.0% | -1.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 99% to 100% | -2.0% | 99% to 100% | -2.2% | -2.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 0.4% | TOTAL | -0.3% | -0.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Subscribe to get insights from our trusted experts delivered straight to your inbox.

[1] Scott Drenkard and Scott Greenberg, “Explaining the Pass-Through Income Anti-Abuse Rules in the Tax Cuts and Jobs Act,” Tax Foundation, Nov. 3, 2017, https://taxfoundation.org/pass-through-anti-abuse-rules-tax-cuts-jobs-act/.

[2] Joint Committee on Taxation, “Estimated Revenue Effects Of The Chairman’s Amendment In The Nature Of A Substitute To H.R. 1, The ‘Tax Cuts And Jobs Act,’ Scheduled For Markup By The Committee On Ways And Means On November 6, 2017,” JCX-46-17, Nov. 3, 2017, https://www.jct.gov/publications.html?func=startdown&id=5027.

[3] Alan Cole, “Economic and Budgetary Effects of Permanent Bonus Expensing,” Tax Foundation, Sept. 16, 2015, https://taxfoundation.org/economic-and-budgetary-effects-permanent-bonus-expensing.

[4] Gavin Ekins, “Time to Shoulder Aside ‘Crowding Out’ As an Excuse Not to Do Tax Reform,” Tax Foundation Fiscal Fact, forthcoming.