New Customs Requirements for Packages to European Union (EU) Countries

If you're shipping packages to countries that follow European Union (EU) customs rules, there are new customs regulations you'll need to follow. If you don't provide more-detailed content descriptions on your customs forms, your packages may be returned or refused. USPS is providing tools to help shippers comply with these new rules.

What You Need to Know

As of March 1, 2023:

- New customs rules apply to all outbound international packages going to European countries that follow EU customs regulations. This includes small personal gifts, ecommerce orders, and military and diplomatic mail (APO/DPO/FPO).

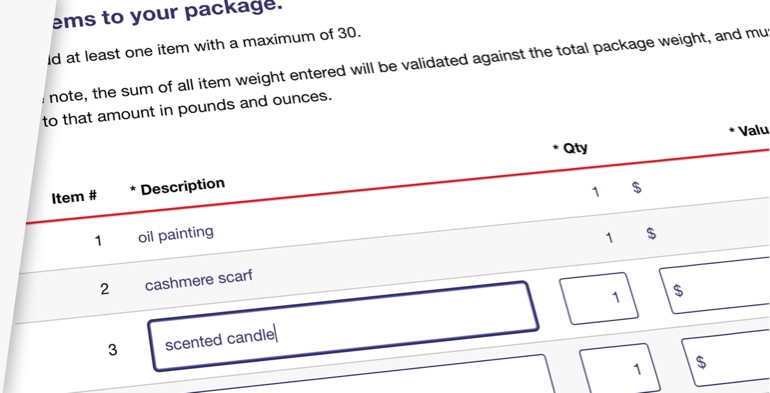

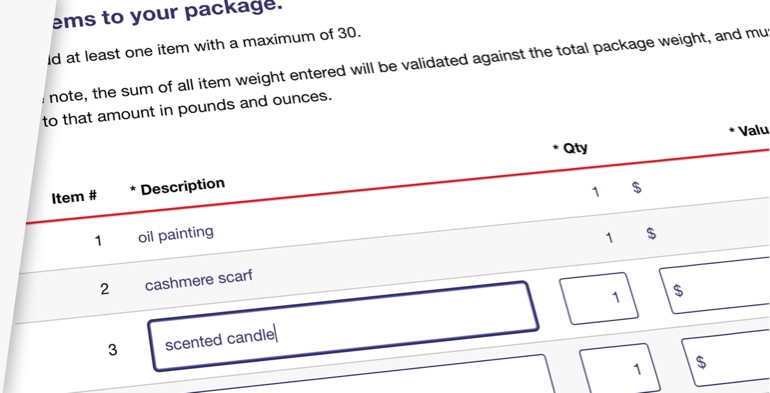

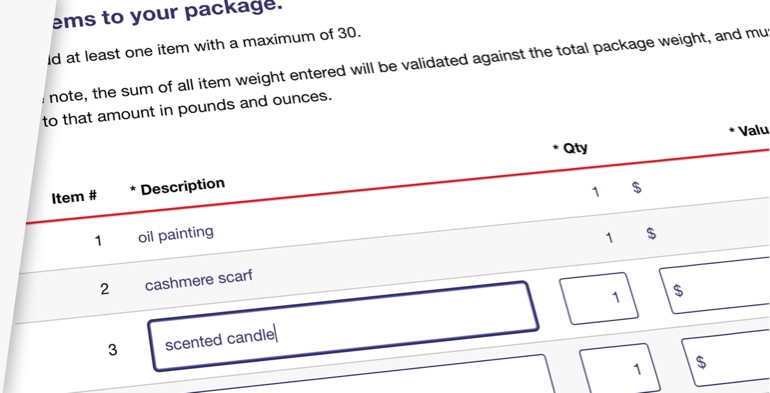

- Every item in your package must be listed on the customs declaration form.

- For each item's description: You can't just name a general category; your description must be specific. For example, you can't just say "electronics"; you have to be specific about the type of electronics, like "computer," "mobile phone," or "television."

- If you use USPS ® tools (like the International Retail Postage Price Calculator or Global Shipping Software) and provide acceptable descriptions (that are specific and accurate), USPS will provide an "HS (Harmonized System) Tariff Code" (or just "HS Code"). This USPS-generated code will be included on your customs declaration form.

Guidance for Acceptable Descriptions

| Unacceptable | Acceptable |

|---|

| Clothes | Men's shirts, girls' vest, boys' jackets |

| Appliances | Refrigerator, stove, microwave oven |

| Artwork | Oil painting, pencil sketch, bronze statue |

| Battery | Lithium batteries |

| Gifts | Scented candle, remote-controlled car, cashmere scarf |

| Medicine | Painkillers, antiviral spray |

| Health & Beauty Products | Detergent, toothbrush, towels |

| Vegetables | Eggplant, onions, broccoli |

Countries That Follow European Union (EU) Customs Rules

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus, Republic of

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

Why These Changes Are Important

Outbound U.S. shippers send tens of millions of packages to EU countries each year. However, if you don't comply with new requirements in EU customs rules, your shipments will be at risk. Don't jeopardize your packages, revenue, and customer satisfaction!

For Businesses

- Prevent loss of international outbound revenue

- Follow new EU regulations, reducing fraud and increasing accountability

- Improve speed and efficiency of cross-border ecommerce

- Meet safety and security requirements, preventing delays, fines, and penalties for noncompliance

- Increase competitiveness

For Consumers

- Know EU rules and how to properly describe contents in international shipments

- Send packages with peace of mind, avoiding delayed, discarded, or destroyed packages

Customs Information for International Shipments to the EU

As of July 2021, all shipments to EU member states require formal customs declarations and are subject to Value-Added Tax (VAT). To ensure uninterrupted customs processing and delivery, formal customs declarations must be completed accurately, including a comprehensive description of goods for each item in the shipment. Detailed instructions are outlined below.

A formal customs declaration must include:

Sender Information

Do not use any abbreviations.

- Name: Complete First Name and Last Name

- Address: Road Name, Number, ZIP Code ™ , City, State

- Contact Information: Phone, Email

Recipient Information

Do not use any abbreviations.

- Name: Complete First Name and Last Name

- Address: Road Name, Number, Postal Code, City, State/Province, Country

- Contact Information: Phone, Email

Item Description

You must include a specific, accurate description for each item in your shipment. For example, if you are sending electronics, you must indicate what type of electronics (e.g., television, computer, mobile phone) for the description to be acceptable.

Acceptable goods descriptions must include:

- Complete, detailed information, explaining the precise nature of the goods in plain language

- An indication of what the goods are, what they are made of, and what purpose they serve

Acceptable Description

- Television

- Mobile phone

- Men's cotton t-shirts

- Polyester women's socks

Unacceptable Description

Item Value

You must include a separate and specific value for all items in your shipment. Once calculated, included a total value for the shipment.

Packet or Package Weight

You must include the total gross weight of the package and the unit of calculation (i.e., pounds or kilograms).

HS Tariff Code

HS Tariff Codes are identifiers linked to specific goods descriptions. Once you have accurately described the item you are shipping, USPS will provide an HS Code for your customs form. In the event that you cannot find an HS Tariff Code, an accurate goods description is enough for customs processing.

Harmonized System Codes are very complex. You can learn more about HS codes here.

What is the Harmonized System?

The Harmonized Commodity Description and Coding System generally referred to as "Harmonized System" or "HS" is a multipurpose international product nomenclature developed by the World Customs Organization (WCO). The system categorizes commodity groups by six-digit codes, creating a universal economic language for the shipping of goods. These codes are used for internal taxes, trade policies, monitoring of controlled goods, rules of origin, freight tariffs, transport statistics, price monitoring, quota controls, compilation of national accounts, and economic research and analysis. The WCO updates the HS every 5 years. 1

Countries often add additional digits to the end of the six-digit code to further classify products. The United States uses a 10-digit code to classify products. 2

What are the Challenges? 3

- The Harmonized System is complex; it is difficult and expensive to implement and requires extensive training.

- Countries create unique sub-classifications that do not align internationally.

- The WCO recommends quantities associated with the HS codes which do not always align with the quantities used in industry practices that vary across countries.

- Frequent revisions of the HS result in the discontinuation or merging of some codes every five years, causing issues in analysis and implementation across countries.

It is recognized that many of the challenges faced by the HS are inherent and unavoidable in any multipurpose international commodity classification.

A solution tailored to small and medium businesses in select markets: USPS Connect ™ Local Mail lets you offer your local customers affordable, same-day/next-day delivery for envelopes and flats (large envelopes) up to 13 oz. You'll get a special flat-rate price for taking your mail to a USPS ® drop-off point close to your customer.

- Use a free USPS.com business account to sign in to the Click-N-Ship ® application. Pay for and Print your USPS Connect Local - Mail labels.

- Take your prepaid packages to the USPS drop-off location by the deadline: Early morning for same-day delivery and 30 minutes before closing for next-day delivery.

- Tip: Free Package Pickup is available in many markets.

USPS Connect Regional

Next-Day Regional Delivery

If you're a business shipping larger batches of packages (50 or 200 at a time, depending on service) to customers in the same region, USPS Connect ™ Regional can help you reach customers with next-day shipping. You'll get special rates and expedited handling for meeting package minimums, pre-sorting packages, and taking them to designated USPS ® facilities close to your customers.

- Speak with a USPS Sales Representative to join USPS Connect Regional.

- Meet package minimums: 50 for Parcel Select, or 200 for Parcel Select Lightweight.

- Pre-sort your packages by ZIP Code ™ .

- Take your prepared shipment to the designated facility: Destination Entry Network Distribution Center (DNDC), Destination Entry Sectional Center Facility (DSCF), or Destination Entry Service Hub.